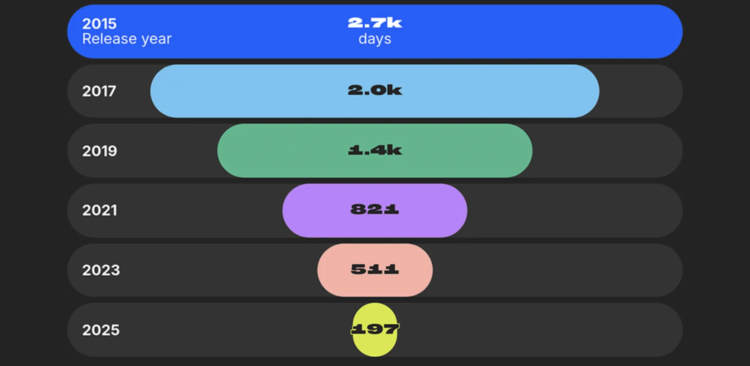

Average number of days required for songs to reach 1 billion streams on Spotify, 2015-2025 (Source: Chartmetric)

Hit songs are happening faster than ever, according to a just-released review of 2025 trends from Chartmetric. It’s also becoming more difficult to hold onto newfound success.

Blame TikTok or our fast-food media culture, but hit songs are now hitting faster than ever — and disappearing from the scene just as quickly. That’s one of several big-picture takeaways emerging from Chartmetric’s just-released review of 2025 music trends, a report that traverses everything from global export volumes to festival bookings.

“In a market constantly chasing the next breakout moment, success is harder to hold—and longevity is no longer guaranteed,” Chartmetric warns in the report, while trotting out a number of critical data trends to support its thesis. Chartmetric, itself a fast-rising music data authority, exhaustively tracks hundreds of platforms worldwide while chronicling the traction of artists and genres.

It’s no easy chore to make sense of the gigantic data pile that now surrounds music consumption. But according to Chartmetric, which recently partnered with DMN to expand its findings, one clear takeaway from 2025 is that success is happening faster, harder, and oftentimes shorter for breakout artists.

Case in point: the time required for a song to reach one billion streams on Spotify has never been shorter, propelled by hundreds of millions of streaming music fans and short-form video scrollers.

“A decade ago, reaching one billion streams was a rare milestone reserved for only a handful of tracks,” Chartmetric explained in their report. “By 2025, that threshold is growing at an exponential rate, with the average time to hit a billion streams falling from 2,729 days in 2015 to just 197 days.”

“This acceleration reflects the combined impact of how streaming adoption, globalized fanbases, and algorithmic discovery are reshaping the rate at which hits emerge.”

Suddenly, surging up the mountain isn’t the hardest part anymore — it’s figuring out how to stay there.

In 2025, Chartmetric noticed something interesting: most of the top-ranked songs on Spotify weren’t released in 2025. Instead, Spotify’s top-performing tracks largely came from 2024 or earlier, with more recent tracks failing to stick. That contrasted sharply with 2024, when more than 70% of the top-ten most-streamed Spotify tracks were released that year.

Despite that trend, three times as many artists achieved Chartmetric’s ‘Superstar’ status in 2025. In other words, artists were blowing up like never before, but their tracks weren’t sticking to the same degree.

But is that a longer-term trend? Perhaps more data is required here, though Chartmetric is predicting a bigger shift ahead.

But where are all these blow-ups coming from? In 2025, the answer was all over the map.

Once-unlikely music-export machines like Puerto Rico and South Korea remained potent in 2025, though Chartmetric also noted a strong surge in the popularity of Bollywood music worldwide. Shockingly, India’s share of Chartmetric’s top 1,000 artists surged from 0.6% to 11% in 2025, a jump the company attributes to a growing globalization of the music ecosystem.

It’s probably too far-fetched to imagine Americans enjoying — or arguing over — a Bollywood-themed Super Bowl Halftime Show anytime soon. Then again, few predicted the absolute explosion in genres like reggaeton over the past decade, much less a guy named ‘Bad Bunny’ entertaining America’s most-watched event.

Speaking of big events: Chartmetric’s 2025 review also revealed some eye-popping details about festival bookings.

Dance-focused festivals like EDC and Ultra Music are now well-established mainstays and clearly focused on electronica. But among more generalized festivals like Coachella, lineups are shifting heavily towards EDM. According to Chartmetric’s data, dance and electronica are now the fastest-growing genres at major US festivals.

Specifically, DJ bookings grew 9% at Bonnaroo, 12% at Lollapalooza, and held steady at 50% of Coachella’s lineup. Of course, that means a reduction in other genres: at Bonnaroo, for example, the lineup now features fewer folk and country acts.

Other data developments from 2025 are worth noting, but not necessarily indicative of broader trends.

For example, Chartmetric tracked some interesting data in 2025 on sync placements across film and TV, with films sourcing more recent releases and TV series leaning more toward catalog tracks. That sounds interesting enough, though it could be premature to project longer trends in this arena.

That’s also true for emerging genres like Bollywood music. Whether this is the beginning of a global Bollywood explosion or simply a hot streak is hard to predict, though if history offers any guidance, genre breakouts and artist blow-ups are rarely predictable. At the very least, Chartmetric offers a whiff of what may be coming next.