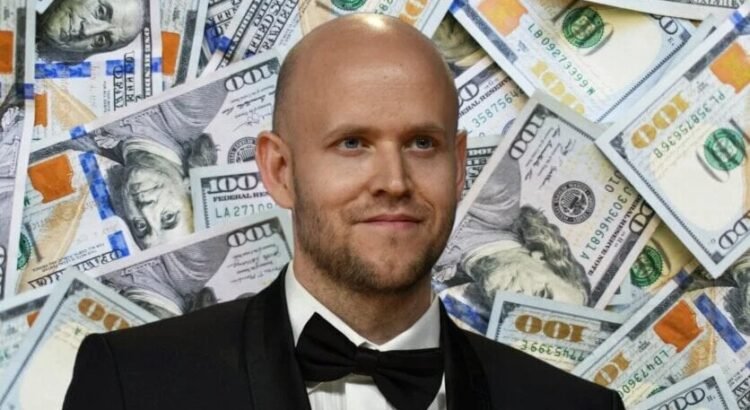

Spotify CEO and co-founder Daniel Ek sold another USD $29.2 million worth of company shares on Wednesday (March 5), continuing a pattern of stock sales just weeks after the streaming platform’s share price reached record highs.

According to an SEC filing, Ek offloaded 50,000 shares at Tuesday’s (March 4) closing price of $584.14 per share.

The transaction occurred despite SPOT’s stock price falling on Tuesday to its lowest level since February 3.

On Wednesday, SPOT closed almost nearly flat, or 0.46% higher, at $586.83.

Ek’s most recent previous divestment was on February 19 when SPOT’s stock price was at $630.56, just two days after the stock hit an all-time high of $648.32.

The latest sale marks Ek’s 15th since July 2023, and brings his total earnings from share sales to $695.3 million, with over half, or $376 million, of that coming in 2024 alone, according to MBW calculations.

- In July 2023, Ek sold 675,000 shares for USD $100 million;

- In October 2023, he sold 400,000 shares for $64.2 million;

- In February 2024, Ek sold 250,000 shares for $57.5 million;

- In April 2024, Ek sold 400,000 shares for $118.8 million;

- In November 2024, Ek sold 75,000 shares for $35.8 million;

- In November 2024, Ek sold another 75,000 shares for $34.8 million;

- In November 2024, Ek sold 75,000 shares again, this time for $36.1 million;

- In December 2024, Ek sold another 75,000 shares $37 million;

- Also in December 2024, Ek sold 60,000 shares for $28.3 million;

- And again in December, Ek sold 60,000 shares for $27.7 million;

- In January 2025, Ek sold 60,000 shares for $27.8 million;

- Also in January 2025, Ek sold 60,000 shares for $29.3 million;

- In February 2025, Ek sold 60,000 shares for $37.3 million;

- Also in February 2025, Ek sold 50,000 shares for $31.5 million;

- And the latest transaction, in March 2025, where Ek sold 50,000 shares for $29.2 million.

Since July 2017, Ek has forgone a traditional salary in favor of a performance-based compensation tied to company growth metrics.

Despite these substantial sales, Ek maintains significant ownership of Spotify with a 14.3% ownership stake carrying 29.1% voting power as of year-end 2024, according to SPOT’s latest annual report.

Fellow co-founder Martin Lorentzon has similarly been selling shares through his Rosello Co. Ltd. holding company, collecting $556.8 million in 2024 while retaining 9.8% ownership with 41.6% voting control.

Since the start of 2025, Spotify’s stock has risen 28% as of Wednesday. On a YoY basis, the stock is up 120%. Some analysts have attributed the performance to the company’s growing user base.

In Q4 2024, Spotify’s global Premium Subscriber base grew 4% to 263 million paying users, or by 11 million net subscribers, on the 252 million the company counted at the end of the prior quarter (Q3 2024). Operating income in Q4 finished at a record high of €477 million (USD $516.2 million based on the annual average exchange rate for 2024).

SPOT said it achieved its first full year of operating income profitability in 2024 at €1.4 billion ($1.52bn).

“Spotify has had a great run of adding subscribers and saw sales growth accelerate over the past year, but the single biggest reason for the stock reaction, in our view, has been the huge move to profitability,” said Morningstar equity analyst Matthew Dolgin on Wednesday.

“A huge rally was warranted, but we’d now say the rally is overdone.”

Matthew Dolgin, Morningstar

“A huge rally was warranted, but we’d now say the rally is overdone,” Dolgin said, warning that investors should approach SPOT stock “cautiously.”

“But we could be interested in a pullback, because we see the company as best in breed.”

Music Business Worldwide