Deductibles? Write-offs? Do the complexities of taxes make your head spin? You’re probably not alone. Whether you’re a full-time musician or a part-time artist trying to make sense of your earnings and expenses, navigating taxes can feel like a daunting task.

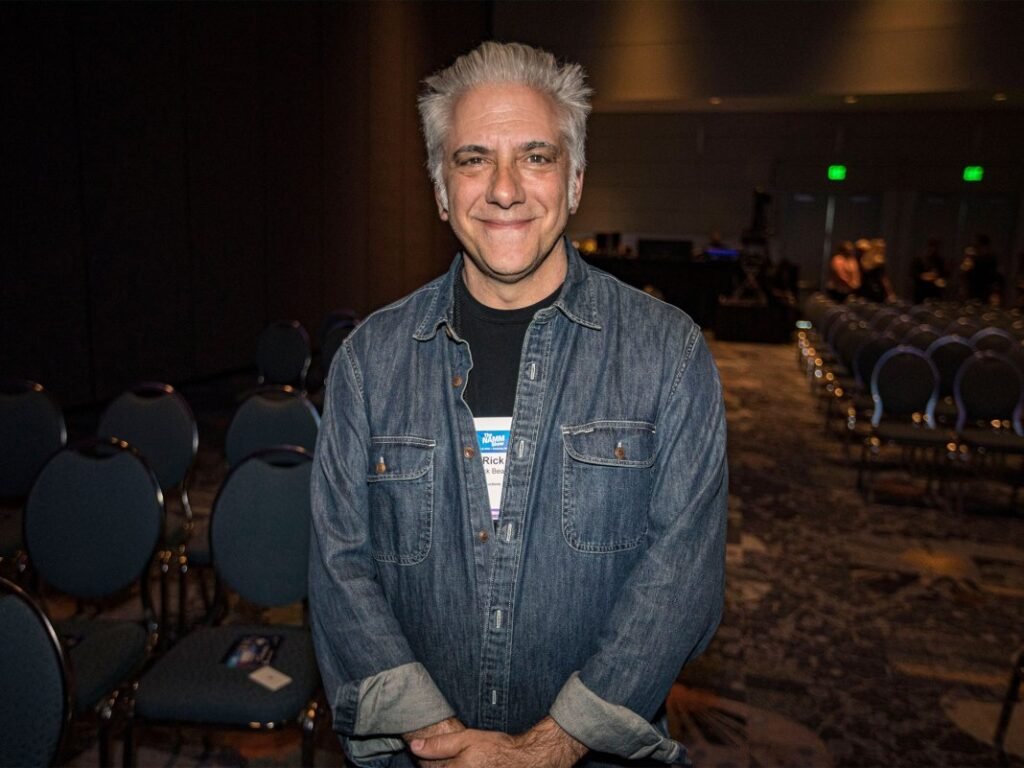

Luckily, Rick Beato is here to break it all down in the simplest way possible, answering even the dumbest tax questions you might have. In a new video, the producer and YouTuber sits down with his accountants Alan Friedman and Evan Kalish, who walk him (and us) through everything a musician needs to know about getting their taxes in order.

To start, the team dives into what musicians can actually write off when it comes to taxes. The rule is simple: you can deduct any expense that is incurred in the production of income in your craft.

For musicians, this means expenses like gear purchases, recording costs, travel costs, and music subscriptions (such as iTunes or Spotify, and even plugin subs) are deductible, as long as they are directly tied to your work.

“You’re selling that music as a producer or an artist,” explains Kalish, who’s also a drummer himself. “In your [Beato’s] case you’re using those plugins to edit YouTube content. So it’s absolutely deductible – it’s generating income.”

Another common myth addressed in the video is the idea that buying gear at the end of the year is always a smart way to reduce taxable income. While it can lower your tax liability, you might still end up spending more money altogether.

To illustrate this, the accountants break down a real-world example: A musician earns $200,000 in a year and has $50,000 in legitimate business expenses, leaving them with a taxable income of $150,000. Based on this, the musician would face a tax bill of around $50,000, factoring in federal, state, and self-employment taxes.

Some musicians might think that they’ll pay less in taxes if they spend an additional $50,000 on equipment. And technically, that’s true — this would drop their taxable income to $100,000, reducing their tax bill to roughly $35,000, saving them $15,000. But here’s the catch: they still spent $50,000 to save $15,000.

During the video, Rick and his accountants also stress the importance of keeping detailed records, as it can massively simplify things when the time comes to file.

Watch the full video below.

See more from Rick Beato via his official YouTube channel.