It’s one of the most interesting charts in the music biz.

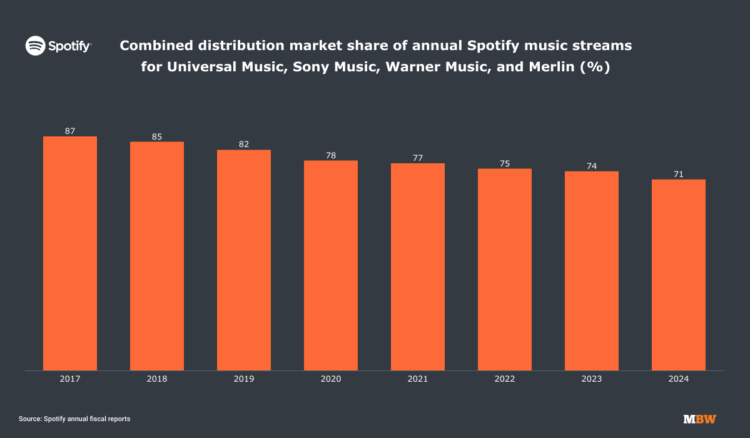

Each year, via its annual 20-F filing with the SEC, Spotify reveals the market share (by streaming volume) of the world’s largest recorded music companies on its platform.

Two important things to understand before we dig in:

- (i) The figure presented by Spotify pulls in all streams of music distributed/represented by the three major music companies plus Merlin. This includes indie labels distributed by the majors and represented in Spotify licensing negotiations by Merlin – but it does not include indie operators who are Merlin members but who strike their own Spotify deals (for example, DistroKid and UnitedMasters);

- (ii) This number refers to the market share of music (not audiobook or podcast) streams globally.

Now that that’s clear, here’s the news: in its latest 20-F report, Spotify says the majors plus Merlin licensed content that attracted 71% of all music plays on its service in 2024.

Take a look at how that number has tumbled over the years:

As you can see, in 2024, the figure fell by 300 basis points YoY, to 71 percent.

Over the past seven years, the figure has reduced by 1,600 basis points, down from from 87% in 2017 (the first year for which we believe Spotify published this measurement).

A couple of things are worth exploring here.

Firstly, the ‘Merlin’ portion of the Spotify figure is slippery to define, as it’s difficult to know how many substantial Merlin members are, in fact, licensing their repertoire directly to SPOT.

(For example: Beggars Group, the large UK-based indie, is understood to license TikTok directly these days, and that may well also carry for Spotify. Larger indies such as these often grant Merlin the right to license their music to smaller DSPs, or non-global DSPs – for example, Tencent Music or NetEase Cloud Music in China – but license larger global DSPs directly themselves.)

Secondly, and importantly, we must remember BMG.

Since the end of 2023, BMG has ‘gone direct’ in its licensing and distribution to Spotify, having previously been distributed by Warner Music Group‘s ADA. (BMG’s physical distribution partner for CDs and vinyl is now Universal Music Group).

Ergo, the ‘majors plus Merlin’ figure for Spotify above would have effectively lost BMG in 2024.

Considering BMG’s size, this wouldn’t have had an insignificant effect on the market share figure.

For the first half of 2024, BMG reported revenue of EUR €459 million (USD $496m), of which 36% – or around EUR €165 million – was derived from its recordings business.

What major record companies really care about, of course, isn’t the market share of the volume of streams on Spotify – but the market share of the money that gets paid out in royalties.

And it’s here that so-called “artist-centric” changes will have helped their cause in 2024.

In Q1 last year, Spotify implemented several alterations to its service, including one key announcement: tracks now needed to reach at least 1,000 streams in the previous 12 months to generate any recorded royalties.

The royalties that would have previously been paid out to the owners of these tracks wasn’t kept by Spotify; it simply went back into the ‘distribution pot’ for those tracks that had topped 1,000 streams.

So when you look at the 71% market share of ‘majors plus Merlin’ in 2024, one needs to remember that any tracks within these market share calculations that failed to surpass 1,000 annual plays wouldn’t have been monetized.

Would this have benefitted the major record companies’ market share of Spotify royalties vs. their market share of Spotify streams?

Almost certainly.

According to Spotify’s latest Loud & Clear statistics, as of the end of 2023, the service had 24.27 million tracks with over 5,000 lifetime plays.

That represented less than a quarter of all music tracks (~100 million) on the platform at the time.

More recently, Luminate reported that 202 million different uploaded tracks (ISRCs) existed on streaming services at the end of 2024, and 175.5 million of them were played fewer than 1,000 times last year (across multiple services).

To run that buy you again: More than 86% of tracks on streaming services were played fewer than 1,000 times last year.

Not played fewer than 1,000 times on Spotify. Played fewer than 1,000 times across all services combined.

That’s a lot of music getting played… but not getting paid.

And, as explained, the money that used to go to these tracks now goes to more popular music… i.e. the specialty of the major music companies.

In the past month, both Universal Music Group and Warner Music Group have announced new multi-year licensing deals with Spotify.

At the heart of both announcements is a promise to keep on exploring “artist-centric” initiatives on Spotify in the future.

Sir Lucian Grainge, Chairman and CEO of Universal, coined the “artist-centric” phrase in a letter to staff at the top of 2023.Music Business Worldwide